2020年11月16日

SOMERSET, N.J.—(BUSINESSWIRE)— November 16, 2020—Legend Biotech Corporation (NASDAQ: LEGN) (“Legend Biotech” or the “Company”), a global clinical-stage biopharmaceutical company engaged in the discovery and development of novel cell therapies for oncology and other indications, today reported financial results for the quarter ended September 30, 2020.

“Legend Biotech continues to execute on our corporate strategy, advancing the development of our lead product candidate, ciltacabtagene autoleucel (cilta-cel), in collaboration with Janssen Biotech, Inc. as well as our other pipeline programs,” said Dr. Ying Huang, Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) of Legend Biotech. “We look forward to initiation of the Biologics License Application (“BLA”) filing for cilta-cel by Janssen Biotech, Inc.”

Third Quarter 2020 & Recent Highlights

Key Upcoming Milestones

Development Pipeline

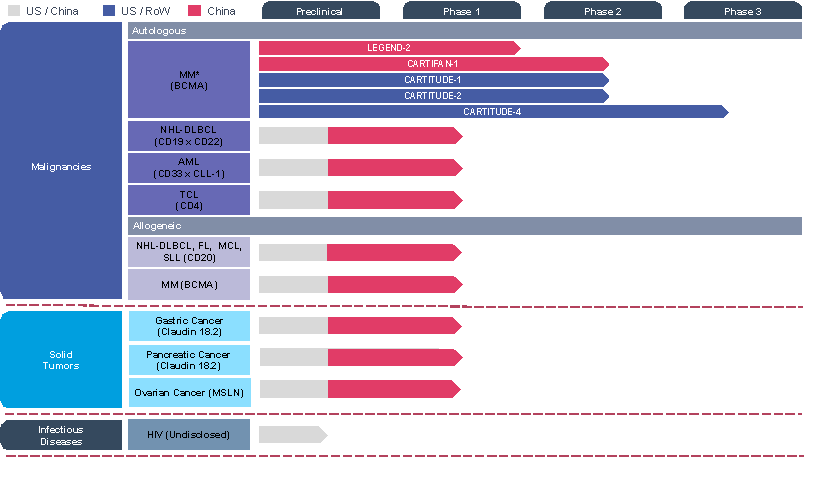

Robust Pipeline of the Next Generation Cell Therapies

AML=acute myeloid leukemia, BCMA=B-cell maturation antigen, DLBCL=diffuse large B-cell lymphoma, FL=follicular lymphoma, HIV= human immunodeficiency virus, MCL=mantle cell lymphoma, NHL=non-Hodgkin lymphomas, MM= multiple myeloma, MSLN=mesothelin, RoW =Rest of World, SLL=small lymphocytic lymphoma, TCL=T-cell lymphoma

*In collaboration with Janssen, Pharmaceutical Companies of Johnson & Johnson

The extent to which the COVID-19 pandemic may impact our business and clinical trials is highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the outbreak and social distancing regulations, travel restrictions, business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain and treat the disease.

Financial Results for the Three-month and Nine-month Periods Ended September 30, 2020

Cash and Cash Equivalents:

As of September 30, 2020, Legend Biotech had approximately$449.4 million of cash and cash equivalents and approximately$125.6 million in time deposits.

Revenue

Revenue for the three months ended September 30, 2020 was $11.7 million compared to $17.7 million for the three months ended September 30, 2019. The decrease of $6.0 million was primarily due to milestone achieved in July 2019 under the agreement with Janssen Biotech, Inc., which resulted in additional consideration being allocated to the licensing of intellectual property and the steering committee service for the three months ended September 30, 2019, net-off by additional milestone that was achieved in December 2019, which resulted in additional consideration being allocated to the steering committee service for the three months ended September 30, 2020. Revenue for the nine months ended September 30, 2020 was $34.9 million compared to $37.8 million for the nine months ended September 30, 2019. Similarly, the decrease of the nine months period in 2020 was primarily driven by additional milestone payment received from Janssen Biotech, Inc. that was achieved in July 2019, net-off by additional milestone that was achieved in December 2019, which resulted in additional consideration being allocated to the steering committee service for the nine month ended September 30, 2020. Legend Biotech has not generated any revenue from product sales to date.

Research and Development Expenses

Research and development expenses for the three months ended September 30, 2020 were $63.7 million compared to $41.9 million for the three months ended September 30, 2019. This increase of $21.8 million was primarily due to a higher number of clinical trials, a higher number of patients enrolled in those trials and a higher number of research and development product candidates in the three months ended September 30, 2020. Consistently, research and development expenses for the nine months ended September 30, 2020 was $165.2 million compared to $95.8 million for the nine months ended September 30, 2019 with a $69.4 million increase.

Administrative Expenses

Administrative expenses for the three months ended September 30, 2020 were $6.0 million compared to $2.0 million for the three months ended September 30, 2019. The increase of $4.0 million was primarily due to Legend Biotech’s expansion of supporting administrative functions to aid continued research and development activities. Due to the consistent business expansion, administrative expenses for the nine months ended September 30, 2020 increased by $9.3 million, which was $14.0 million compared to $4.7 million for the nine months ended September 30, 2019.

Selling and Distribution Expenses

Selling and distribution expenses for the three months ended September 30, 2020 were $9.3 million compared to $4.5 million for the three months ended September 30, 2019. This increase of $4.8 million was primarily due to increased costs associated with commercial preparation activities for cilta-cel. Driven by the same commercial preparation activities, selling and distribution expenses for the nine months ended September 30, 2020 was $25.4 million compared to $12.2 million for the nine months ended September 30, 2019.

Other Income and Gains

Other income and gains for the three months ended September 30, 2020 was $1.5 million compared to $3.0 million for the three months ended September 30, 2019. The decrease was primarily driven by net foreign exchange loss incurred, net of an increase in government grant received. Other income and gains for the nine months ended September 30, 2020 was $5.3 million compared to $6.6 million for the nine months ended September 30, 2019. The decrease of the nine months period was primarily driven by reduced average interest rate for holding of time deposits that generate interest income.

Other Expenses

Other expenses for the three months ended September 30, 2020 was $1.2 million compared to $0.002 million for the three months ended September 30, 2019. Other expenses for the nine months ended September 30, 2020 was $1.3 million compared to $0.2 million for the nine months ended September 30, 2019. The increase was primarily due to foreign exchange loss.

Loss for the Period

For the three months ended September 30, 2020, net loss was $66.5 million, or $0.25 per share, compared to a net loss of $27.8 million, or $0.14 per share, for the three months ended September 30, 2019. Net loss was $245.7 million for the nine months ended September 30, 2020 compared to $69.0 million for the nine months ended September 30, 2019.

Grant of restricted share units and share options

On September 1, 2020, we granted a total number of 777,382 restricted share units (each representing the right to receive one ordinary share) to grantees with a grant date fair market value of $16.335 per share. On September 1, 2020, we granted share options, representing the right to acquire a total number of 569,000 shares to grantees with an exercise price of $16.335 per share.

About Legend Biotech

Legend Biotech is a global clinical-stage biopharmaceutical company engaged in the discovery and development of novel cell therapies for oncology and other indications. Our team of over 800 employees across the United States, China and Europe, along with our differentiated technology, global development, and manufacturing strategies and expertise, provide us with the strong potential to discover, develop, and manufacture cutting edge cell therapies for patients in need.

We are engaged in a strategic collaboration with Janssen Biotech, Inc. to develop and commercialize our lead product candidate, ciltacabtagene autoleucel, an investigational BCMA-targeted CAR-T cell therapy for patients living with multiple myeloma. This candidate is currently being studied in registrational clinical trials.

Cautionary Note Regarding Forward-Looking Statements

Statements in this press release about future expectations, plans and prospects, as well as any other statements regarding matters that are not historical facts, constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements relating to Legend Biotech’s strategies and objectives; the anticipated timing of, and ability to progress, clinical trials; the ability to make, and the timing of, regulatory submissions globally, including the BLA for cilta-cel to the U.S. FDA, the marketing authorization application (MAA) for cilta-cel to the EMA, regulatory submission filing for CARTIFAN-1 in China and the Investigational New Drug Application (IND) of LB1901, a CAR T product under development for the

treatment of relapsed or refractory T-cell lymphoma (TCL), to the U.S. FDA; the ability to generate, analyze and present data from clinical trials; patient enrollment; the potential benefits of our product candidates, the status and outcome of the Investigation and its impact on the Company’s operations. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the factors discussed in the “Risk Factors” section of the prospectus filed with the Securities and Exchange Commission on June 8, 2020. Any forward-looking statements contained in this press release speak only as of the date hereof, and Legend Biotech specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Readers should not rely upon the information on this page as current or accurate after its publication date.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019

Three months ended September 30

Nine months ended September 30

| (in thousands, US$, except per share data) 2020 2019 2020 2019 (unaudited) (unaudited) (unaudited) (unaudited) REVENUE……………………………………………………………….. 11,747 17,674 34,893 37,814 Other income and gains…………………………………………… 1,519 2,987 5,315 6,649 Research and development expenses ……………………… (63,656) (41,917) (165,226) (95,846) Administrative expenses………………………………………….. (6,038) (1,992) (13,976) (4,704) Selling and distribution expenses……………………………… (9,287) (4,460) (25,389) (12,246) Other expenses ………………………………………………………. (1,249) (2) (1,331) (216) Fair value loss of convertible redeemable preferred shares …………………………………………………………………. — — (79,984) — Finance costs …………………………………………………………. (90) (82) (4,169) (139) LOSS BEFORE TAX……………………………………………….. (67,054) (27,792) (249,867) (68,688) Income taxes credits / (expenses) ……………………………. 508 (5) 4,217 (341) LOSS FOR THE PERIOD…………………………………………. (66,546) (27,797) (245,650) (69,029) |

Attributable to:

Equity holders of the parent (66,546) (27,797) (245,650) (69,029)

LOSS PER SHARE ATTRIBUTABLE TO ORDINA RY EQUITY HOLDERS OF THE PARENT

Ordinary shares—basic (0.25) (0.14) (1.08) (0.35)

Ordinary shares—diluted (0.25) (0.14) (1.08) (0.35) ORDINA RY SHARES USED IN LOSS PER SHARE

| 264,328,630 200,000,000 226,764,437 200,000,000 264,328,630 200,000,000 226,764,437 200,000,000 |

COMPUTATION

Ordinary shares—basic Ordinary shares—diluted

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS AT SEPTEMBER 30, 2020 AND DECEMBER 31, 2019

September

(in thousands, US$)

30, 2020

(Unaudited)

December 31, 2019

NON-CURRENT ASSETS

Property, plant and equipment ……………………………………………………………………… 96,125 70,079

Advance payments for property, plant and equipment ……………………………………. 675 665

Right-of -use assets …………………………………………………………………………………….. 8,077 9,348

Intangible assets ………………………………………………………………………………………… 1,042 519

Total non-current assets……………………………………………………………………………… 105,919 80,611

CURRENT ASSETS

Inventories………………………………………………………………………………………………….. 1,513 1,157

Trade receivables……………………………………………………………………………………….. — 29,991

Prepayments, other receivables and other assets …………………………………………. 24,662 16,777

Financial assets at fair value through profit or loss ………………………………………… 1,175 —

Pledged short-term deposits………………………………………………………………………… 430 256

Time deposits …………………………………………………………………………………………….. 125,559 75,559

Cash and cash equivalents ………………………………………………………………………….. 449,381 83,364

Total current assets ……………………………………………………………………………………. 602,720 207,104

Total assets ……………………………………………………………………………………………….. 708,639 287,715

CURRENT LIABILITIES

Trade and notes payables …………………………………………………………………………… 7,399 9,586

Other payables and accruals……………………………………………………………………….. 67,889 70,854

Lease liabilities ……………………………………………………………………………………………. 1,445 1,027

Contract liabilities ………………………………………………………………………………………… 46,789 46,294

Total current liabilities ………………………………………………………………………………….. 123,522 127,761

NON-CURRENT LIABILITIES

Contract liabilities ………………………………………………………………………………………… 245,641 277,765

Lease liabilities ……………………………………………………………………………………………. 2,543 5,058

Government grants …………………………………………………………………………………….. 2,033 —

Total non-current liabilities……………………………………………………………………………. 250,217 282,823

Total liabilities ……………………………………………………………………………………………… 373,739 410,584

EQUITY

Share capital………………………………………………………………………………………………. 26 20

Reserves / (deficits) ……………………………………………………………………………………. 334,874 (122,889)

Total ordinary shareholders’ equity / (deficit) ………………………………………………… 334,900 (122,869)

Total equity / (deficit) ………………………………………………………………………………….. 334,900 (122,869)

Total liabilities and equity…………………………………………………………………………….. 708,639 287,715

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019

| Three months ended September 30 | Nine months ended September 30 | |

| (in thousands, US$) | 2020 2019 (Unaudited) (Unaudited) | 2020 2019 (Unaudited) (Unaudited) |

| LOSS BEFORE TAX…………………………………………………………….. | (67,054) (27,792) | (249,867) (68,688) |

| CASH FLOWS (USED IN)/GENERATE D FROM OPERATI NG | ||

| ACTIVITIES………………………………………………………………………. | (64,375) 19,947 | (167,056) (23,078) |

| CASH FLOWS USED IN INVESTING ACTIVITIES ………………….. | (58,623) (21,194) | (85,334) (172,103) |

| CASH FLOWS FROM/(USED IN) FINANCING ACTIVITIES …….. | 9,663 (154) | 618,221 21,346 |

| NET (DECREASE)/ INCREASE IN CASH AND CASH | ||

| EQUIVALENTS…………………………………………………………………. | (113,335) (1,401) | 365,831 (173,835) |

| Ef fect of foreign exchange rate changes, net ………………………….. | 325 (44) | 186 (55) |

| Cash and cash equivalents at beginning of the period …………….. | 562,391 37,721 | 83,364 210,166 |

| CASH AND CASH EQUIVALENTS AT END OF THE PERIOD…. |

ANALYSIS OF BALANCES OF CASH AND CASH EQUIVALENTS

| Cash and bank balances ………………………………………………………. | 575,370 | 147,592 | 575,370 | 147,592 |

| Less: Pledged short-term deposits…………………………………………. | 430 | 255 | 430 | 255 |

| Time deposits ………………………………………………………………. | 125,559 | 111,061 | 125,559 | 111,061 |

Cash and cash equivalents as stated in the statement of

f inancial position……………………………………………………………….. 449,381 36,276 449,381 36,276

Cash and cash equivalents as stated in the statement of cash

f low s ………………………………………………………………………………. 449,381 36,276 449,381 36,276

Media and Investor Relations:

Jessie Yeung, Headof Corporate Finance and Investor Relations, Legend Biotech jessie.yeung@legendbiotech.com or investor@legendbiotech.com

Surabhi Verma, Manager of Investor

Relations and Corporate Communications, Legend Biotech surabhi.verma@legendbiotech.com or media@legendbiotech.com

For Medical Affairs inquiries, please contact:

Tonia Nesheiwat, Executive Director, Medical Affairs, Legend Biotech USA Inc. tonia.nesheiwat@legendbiotech.com or medicalinformation@legendbiotech.com

Source: Legend Biotech

欧盟委员会批准 CARVYKTI®用于复发和难治性多发性骨髓瘤患者的二线�..

2024年4月23日

传奇生物CARVYKTI®成为首个且唯一获FDA批准用于多发性骨髓瘤二线治�..

2024年4月5日

传奇生物发布首份环境、社会和管治(ESG)报告

2024年3月19日

CARVYKTI®获得美国FDA肿瘤药物咨询委员会用于复发或难治性多发性骨�..

2024年3月16日

传奇生物公布2023年全年及第四季度业绩及近期亮点

2024年3月11日

传奇生物获得CHMP对CARVYKTI®用于前线治疗的积极意见

2024年2月23日